Full Disclosure: I recently watched Always Be My Maybe on Netflix and am going to incorporate as many references as I can into this post. Go watch it. It’s my favorite Keanu Reeves movie.

Well-Intentioned Peer Pressure: It’s a Thing

I’ve attempted to peer pressure—uh, I mean, “refer” many friends and family members for credit cards I find valuable. We all want to share how we travel free, eat free, drink free, and save money through perks with the people we love. The referral bonuses aren’t bad either. But sometimes, no matter how rational you are, the well-intentioned sales pitch won’t work.

There are three responses I’ve encountered when imposing my well-intentioned peer pressure:

- Person does their research and signs up. I get a referral bonus. All is right in the world.

- Person thinks I am selling snake oil for a referral bonus. Doesn’t sign up or waits a year and signs up without using referral link. Horrible friend. Looking at you, Derek.

- Person who is absolutely and debilitatingly terrified of credit cards.

This post focuses on #3 and how I have successfully convinced several terrified humans to save some money out of the kindness of my heart (and for dope referral bonuses).

People Who Should Be Terrified of Credit Cards

Some people should be terrified. I was giving a fearful friend without a points-earning card the Chase Sapphire Preferred sales pitch. It went something like this:

“Dude, you are being stupid. You spend $1,000 in rent per month, eat out a bunch, and have been on like five trips this year. Put your spend on the card and get the 50,000 point bonus. If you use the points sparingly, you could get three or four domestic round-trip flights for free. You also spend a disgusting amount at bars and restaurants, so you might as well earn 2x points on your bad habit.”

His response was horrifying. He said, “I don’t need anymore credit card debt, man.” I immediately retracted my sales pitch. I told him to forget about our conversation. If you’re an individual who thinks that a credit card limit is a license to spend, stop reading now. Seriously, go read this money-managing scripture. Now.

People Who Are Foolish Not to Consider Additional Credit Cards

It couldn’t be more simple. If the credit card leaves more money in your financially-responsible pocket than by not having it at all, you have to consider it.

Case Study 1: The Aunty Who Could Not Be Reasoned With

My aunt called me last year asking for help to plan a two-week trip for her family of five to Japan and Vietnam. We monitored flights for about three months and found a killer deal on a destination open-jaw flight. Denver to Tokyo. Tokyo to Hanoi. Saigon to Denver. It was still going to cost some big money.

She told me that I could charge it to one of my credit cards if I wanted and she would reimburse me. God bless her soul. My heart rate spiked and numbers started appearing around me. She told me that her trip and charges were likely to exceed $10,000. If I used my Chase Sapphire Reserve, I would rack up 30,000 Chase Ultimate Rewards (UR) points (3x points on travel and dining).

However, I’m not a monster.

My pesky morality got in the way. I told her that as much as I appreciated her offer, it would be unethical for me to benefit from a trip that expensive when she could. I gave her the Chase Sapphire Reserve (CSR) sales pitch.

It went like this:

Me: Aunty, you’re gonna spend $10,000 on this trip. You need to sign up for the CSR. You will get a 50,000-point bonus just by buying the flights and 30,000 points just by using the card for your charges.

Aunty: How much is that worth?

Me: $1,200 for any travel booked through Chase at a minimum just for signing up. Also, there are five of you traveling and the CSR comes with Priority Pass lounge access. That’s all the airport food, soft drinks, and whiskey your teenagers can drink—for free. It also comes with travel insurance—which I know you will buy for $100/person.

Aunty: Is there a fee?

Me: $450, but there is a $300 travel credit that automatically gets reimbursed, so it’s only truly $150 and—

Aunty: No, I don’t want it then.

Me: *Arguing in support of the CSR fee for the next 30 minutes*

Aunty:

Me:

We reached a compromise. I made her an authorized user for $75 so she could get the travel insurance protections and Priority Pass. She loved the airport lounges (note: this was prior to the PP companion limit) and saved $500 on travel insurance.

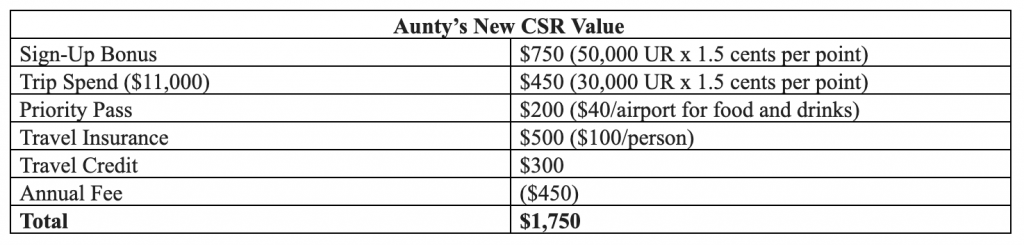

She spent $11,000 on my card for that trip. Aunty gave me 30,000 UR and it almost feels dirty because of how much value she passed up because of her fear of credit cards. Let’s break it down.

Cost-Benefit Breakdown: $11,000 Travel and Dining Spend

My aunt is an amazing human but f’ed up bad. Man, she is gonna give me a lecture for this post. Worth it. Almost the entirety of the $11,000 was flights, hotels, or food. Let’s just assume her spend netted 30,000 UR points. I’ll be conservative.

Aunty missed out on $1,000 on this trip alone because she was too afraid to sign up for the card. She received the value of travel insurance and lounge access as an authorized user. As a reminder, the CSR comes with a $300 travel credit that is automatically reimbursed to your account. Aunty’s “real annual fee” would have been $150 ($450 annual fee – $300 annual travel credit).

Aunty paid me $75 for an authorized user card. That means that for an additional $75 ($150 – $75), she would have netted an additional $1,000.

The story still haunts me to this day. I’ll eventually get over it with the points she gave me.

Case Study 2: Mom Did Her Research

This one is quick. I told my mom all about the various reasons why she should get a Chase Ink Preferred card. Besides an out-of-this world 80,000-point bonus, it also covers phone insurance if the phone bill is charged to the card. She did the research and the math. She paid $40/month ($480/year) on phone insurance at the time. The annual fee was $95. $480 is more than $95. She signed up the next day. Boom. She cancelled her Verizon phone insurance the next day. She gave me the bonus points. Seriously guys, God bless these women.

Takeaway: General Fear of Credit Cards is Costing You Money

When an annual fee doesn’t make sense to me anymore, I downgrade the card to a no-fee card and shoebox it. I did that with three cards this year. I renewed the cards that made sense and am looking at about $1,400 in annual fees this year. Totally worth it. Seriously. I’m a modern millennial. If someone else will give me a discount for my bad habits, then I’m all for it. I’ll give a couple examples of some high fee cards and why they make sense to me.

Other Cards You Might Consider

The $550 American Express Platinum makes sense to me because it gives an annual $200 in Uber credits, $200 airline fee credit, $100 Saks Fifth Avenue Credits (where do you think I’ve been buying socks every year) and access to Centurion Lounges (note: I am so pumped for the Denver Centurion Lounge). For those of you that would like to add FREE GLOBAL COWORKING to that long list of benefits, check out the WeWork membership benefit available to American Express Business Platinum card holders.

Also, Amex provides a ton of perks through their Membership Rewards program and gave me a seriously dope retention offer.

The $250 American Express Gold is amazing. If it had Centurion access, I would cancel my Platinum in a heartbeat. It comes with $120 in GrubHub credits and a $100 airline fee credit. It gives you 4x points on dining and grocery stores. Let me reiterate. Another way to think of that is a minimum 4% off your bar (considered restaurants) tabs and grocery store booze. And I mean, a minimum 4% for groceries and stuff too.

Final Takeaway

I think I’ve explained sufficiently why the $450 CSR is dope above so I won’t bore you again. I’ll save the “why these fees make sense” post for another day, but just know that I’ve run the numbers and I get significantly more value out of these cards than I pay in fees. In conclusion, fight the good fight and carry on with your well-intentioned peer pressure of friends and family—and get those referral bonuses.

The post The “Credit Card Referral Bonus” Sales Pitch & When to Shut Up was first published on Coworkaholic.